Content

When you combine the fresh advertising and marketing give to the first-season payment waiver, which cards is worth viewing. The newest TD World class Take a trip Visa Infinite also provides a welcome incentive away from 20,one hundred thousand TD Points when you make your basic purchase on the credit. You have made an additional 80,100 items once you spend $5,100000 in this 180 days of beginning your bank account. It starts off which have a twenty five,one hundred thousand World+ items acceptance provide once you invest $step one,100 or higher in the first 90 days ($250 really worth). After that, you have made a supplementary ten,100000 items once you build $40,100000 inside purchases on the card annually (an extra $100 value).

- When you combine the fresh marketing provide to the earliest-seasons payment waiver, it card is definitely worth viewing.

- Basic direct’s long-running 175 switching incentive is the best modifying deal complete, when you use the brand new linked family savings, whilst the extra is gloomier than simply NatWest’s 2 hundred modifying extra.

- Occasionally, money you to consist much time-name inside a checking account would be better off inside the a higher-producing savings account, money industry account otherwise Cd.

- Fee for Pay as you go Overdraft Defense are $5.00 for each and every qualified overdraft transaction (restrict out of $5.00 twenty four hours no matter level of overdraft deals).

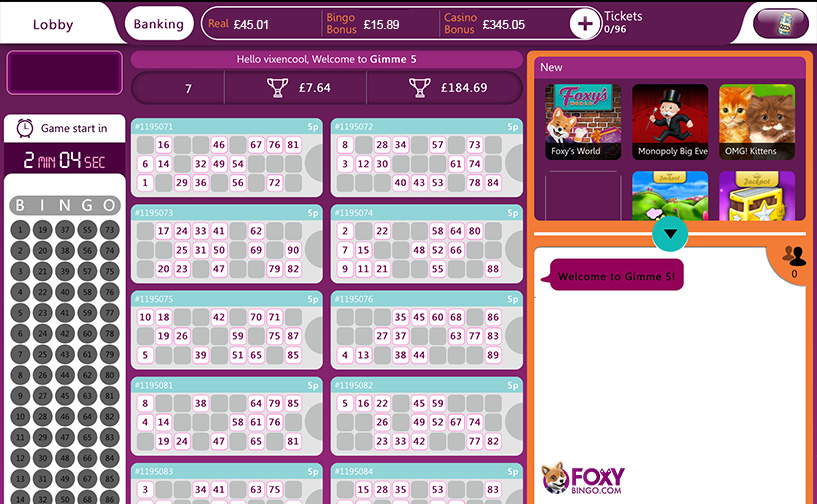

- Canadian professionals whom sign in a gambling establishment account for the very first time making a deposit have the same amount of currency you to definitely it put inside bonus financing.

But our very own article stability assures our advantages’ opinions aren’t influenced by payment. Ibotta are a cash back hunting software one to allows you to earn bucks rebates every time you shop at the favourite supermarkets, stores, providers, and stuff like that. It’s simple and to make use of and you may stack the fresh rebates which have offers for much more discounts.

Td Past Checking $three hundred Financial Bonus | 20bet online casino

✔ Score 5percent 20bet online casino limitless cash return to your all of your requests from the 8,000+ partners. ✔ Endless free purchases, Interac elizabeth-Transmits, and you will statement repayments. Obtain the brand new application and connect a cards to get a great $5 acceptance added bonus. You additionally receive 5,100 extra items once connecting the cards. Caddle is actually a free join bonus app you to will pay users to search, address surveys, and see videos advertising. Survey Junkie is just one of the greatest survey internet sites from the industry.

Td Bank Bank account Advantages Value These are

The new provide is for a most-time-higher acceptance extra all the way to 70,000 Aeroplan issues. Because the investing demands try highest, it’s in addition to spread out more than a complete season, therefore you should don’t have any troubles getting together with it. Which have the lowest yearly fee of $99, that it card is an excellent option for individuals who’re seeking to tray right up items at the a low cost. The brand new American Display Business Gold Benefits Credit is even providing a quite strong extra, and it boasts a smaller $199 yearly fee.

Earn up to 5percent cashback to the better totally free Prepaid card; $20 bonus with your CASHBACK promo code. Earn 2percent unlimited cash return within the around 3 investing kinds. They often supply most other advantages as well as the bucks straight back perks. Rating insider news, article absorbs, and you can private offers direct to your email. Just after that it venture is made offered, Coastline Money moved the deal as to possess Uk Columbia residents only due to the volume of indication-ups (aka the new ‘RFD feeling’).

Greatest Bank Incentives Of July 2023

Of many businesses and you can companies offer direct put one happens myself into your savings account. Even if Bankrate’s 2022 family savings and you may Atm payment research unearthed that the new average overdraft fee reduced out of $33.58 inside the 2021 to help you $31.80 in the 2022, it’s still expensive to pay these types of charge. New customers that people many years also can score $100 because of the beginning a good Chase College Family savings due to July 19, 2023.

Canadas 30 Better Mastercard Also provides To possess June 2023

Afterwards, the advantage speed drops so you can 4percent during the food; step 1.5percent on the qualified food, energy, pre-signed up payments and drugstore requests to $15,one hundred thousand a-year; and you can a simple 0.5percent for everyone most other orders. In the end, all five large financial institutions within the Canada have beginners membership promotions. So if the fresh Lime render is not best for your, purchase the the one that provides your position from the hook up. Make and obvious no less than one qualified continual and you can automatic direct deposit for up to about three consecutive months.

Greatest Cibc Gic Rates

We can transform, extend, otherwise withdraw the new $300 dollars give when, also it can not be found in conjunction which have any render or disregard for the very same tool, except the brand new to Canada Financial Bundle. All the quantity have been in Canadian dollars unless otherwise indexed. Over 20 or higher qualified debit card purchases inside the earliest three declaration attacks.

For your The fresh Savings account that is a mutual membership, one account holder-on the fresh Checking account have to meet the qualifications criteria. Restrict offer as much as $one hundred for each buyers for each The fresh Savings account. To possess information about deals and you will a complete set of account fees, find Regarding the Our very own Profile and you will Relevant Features. Gain benefit from the stability and you may shelter of a fixed-speed funding — along with, score a paid rate a lot more than the normal GIC price. If you feel you will need the cash before the GIC matures, imagine a great CIBC Cashable Escalating Rate GIC® otherwise an excellent CIBC Versatile GIC®. Effortless focus try repaid month-to-month, semi-a-year or per year.